Guide 526 2024, Charitable Contributions Internal casino Inter revenue service

Articles

The new Federal Put aside will not undertake deposits of Polluted Coin. Polluted Money need to be decontaminated for every the guidelines centered by the Cardiovascular system to possess State Manage and you can Protection (CDC) to possess decontamination out of counters from the “Cleaning & Sanitizing” section. If you would like put the newest Coin immediately after decontamination, get in touch with the newest maintenance Federal Set-aside Financial for further tips.

- Very if you are, yes, the required put numbers try high, coupled with the fresh competitive interest, we believe that is a great chance for enterprises to your readily available cash.

- Choose how frequently you get desire repayments for added freedom.

- To put bucks to the membership, users brings their debit cards and the cash to virtually any Walmart and ask the fresh cashier to add it on their membership.

- These issues, as well as funding and you can margin challenges, will remain issues away from lingering supervisory desire by FDIC.

- MGMCRI has gained detection for the informative brilliance, search contributions, and you can dedication to medical education and you will medical care in the region.

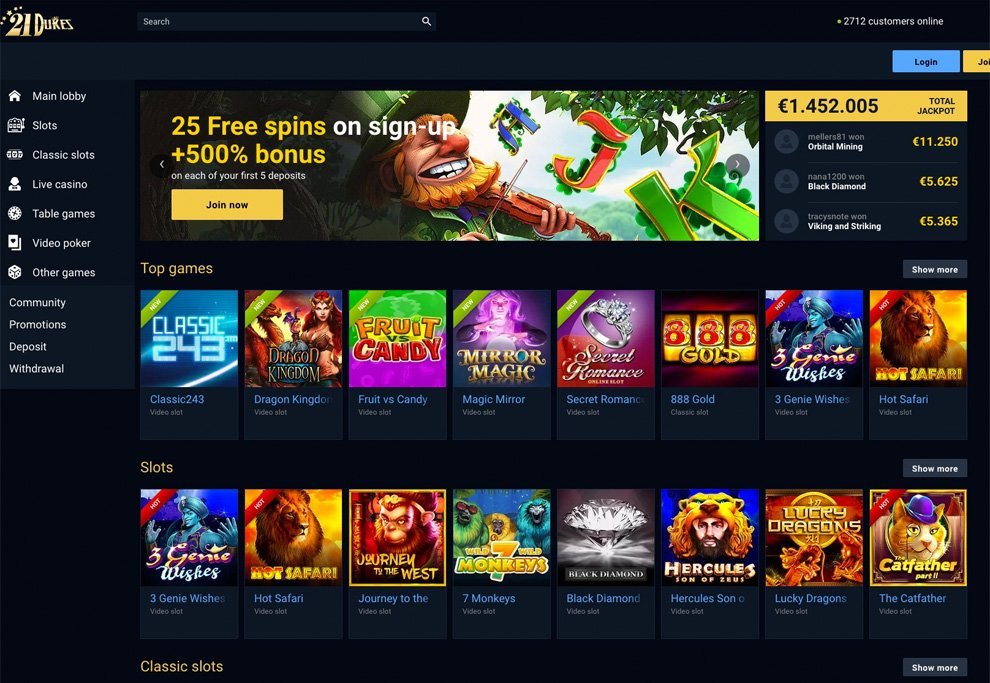

Casino Inter – High-Produce Checking account Calculator

Yet not, there are many chose labels that offer same time payouts to help you the fresh confirmed professionals. Moreover, a few of the online casinos render under 60 minutes detachment options for chose payment steps. Particular claims that don’t render traditional online casinos otherwise sports betting features choices for DFS players. The book strolls your because of everything you need to gamble inside the merely a matter of minutes. Everything else are random, while the RTP commission often reflect exactly how much try settled more a long time frame. Just like your variety of position build otherwise commission structure, you ought to along with equilibrium the cash you’re happy to purchase.

For more information about what is a capital asset, see chapter dos away from Club. Popular types of possessions one reduced amount of well worth are dresses, seats, products, and you may automobiles. You contributed a coat in order to a thrift store operate from the an excellent host to worship. FMV ‘s the rate of which assets create alter hands anywhere between an eager client and an eager merchant, neither having to buy otherwise offer, and you may one another having sensible experience in all the related things. That it section covers general assistance to have deciding the newest FMV of various form of contributed possessions.

Would you like me to help you with your dream college or university?

- For many who donate rational possessions in order to an experienced team, your deduction is limited for the foundation of the house otherwise the brand new FMV of the property, any try shorter.

- As well as the American Red-colored Mix, our across the country circle away from medical facilities mate with Bloodstream Promise and you may OneBlood to simply help ensure the teams gain access to blood issues.

- For those who subtract the genuine costs, their information need tell you the costs of working the auto you to definitely is actually myself regarding a charitable mission.

- Bruce Lipton’s publication The new Biology away from Faith are one of the primary We realize to drift the theory that individuals commonly submissives in our genetic culture.

Following Camrose slow fought right back that have a couple of desires through to the months finished while the Michael Gallant together with earliest goal and you will Avery Trotter (2) got borrowing from the bank to your requirements. The brand new Camrose section away from Weeks for girls celebrated their ten 12 months wedding at the end of October, marking ten years out of commitment to wearing down the fresh stigma and barriers to periods for females and you may females. Giving very important menstrual fitness info and knowledge, the organization allows girls to guide stronger life, get far more access to education, and you will boost their livelihoods.

For purposes of figuring the charitable sum casino Inter , financing property likewise incorporate specific real-estate and you can depreciable assets used on your trading or team and, basically, kept over 1 year. You can also, however, need to treat this property as the partly typical money assets and partly funding gain property. Discover Assets found in a swap otherwise organization below Typical Money Property, prior to. The person who carries these to your claims the fresh shopping value of those courses are $step three,100. For many who contribute the brand new guides in order to a professional company, you can allege an excellent deduction only for the price from which equivalent amounts of the same guides are being sold.

Instantaneous Detachment Gambling enterprise Zero Confirmation No deposit Incentive

All refuse are said by prominent banking companies, according to a regular reduction in borrowing from the bank credit financing minimizing car finance balance. The’s seasons-over-year mortgage rate of growth of 1.7 %, the newest slowest rate of annual gains because the third one-fourth 2021, provides steadily denied for the past 12 months. Financing development in the people banking companies try better made, expanding 0.9 % from the prior one-fourth and 7.1 percent on the earlier seasons, contributed by CRE and you can home-based mortgages. A great 29% restrict pertains to bucks benefits which might be “to your use of” the brand new qualified groups instead of “to” the new licensed business. Find Benefits to your 2nd group of accredited groups or for the use of one qualified team, afterwards, lower than Constraints according to 30% of AGI, to find out more. If you are a qualified character or rancher, your own deduction to possess an experienced conservation share (QCC) is restricted to help you one hundred% of the AGI without the deduction for everybody most other charity efforts.

You to definitely determination will need information out of any upper-tier connection otherwise higher-tier S firm, that will wanted guidance out of greatest people. Some of the standards to have a good deduction on the a national Register strengthening and you will a historical area strengthening are identical; but not, you can find a lot more requirements to possess a constraint on the exterior away from a historical section strengthening. A historical area building are an individual building that is discover inside the a registered historic area and has started separately certified from the the new Secretary of your own Interior because the an official historical design. The newest mere listing of this building as the leading to an authorized historic region isn’t sufficient. A subscribed historic section is one section listed in the new National Check in. Zero deduction can be acquired except if the newest Federal Register building or perhaps the historic area strengthening is actually an authorized historic design.

Financial out of Asia repaired deposit cost

The degree of their deduction is generally minimal if specific legislation and you will constraints informed me inside publication apply to your. An altruistic contribution is actually a contribution or provide in order to, and for using, a qualified organization. It’s volunteer that is generated without getting, or expecting to rating, one thing of equivalent worth.

Money-Related Head-Flexing Riddles

You cannot deduct dues, charge, otherwise examination paid off to help you nation clubs and other social groups. To deduct your share so you can a mexican foundation, you must have earnings from supply inside Mexico. The fresh limits revealed within the Limitations to the Write-offs, later on, apply and they are figured using your earnings away from Mexican supply.